Should I be registered as a resident in Spain?

MAIN QUESTIONS ABOUT BEING REGISTERED AS A RESIDENT IN SPAIN

IS IT MANDATORY?

NO, IT IS NOT. It is a RIGHT.

According to Orden PRE/1490/2012, dated July 9, by which rules are issued for the application of article 7 of Royal Decree 240/2007, of February 16, on entry, free movement and residence in Spain of citizens of the States members of the European Union and of other States parties to the Agreement on the European Economic Area, citizens of a Member State of the European Union or of another State Party to the Agreement on the European Economic Area and of Switzerland have the right of residence in Spanish territory for a period exceeding three months if they fall into one of the following situations.

This right isn’t determinant. You will need to fulfill some requirements that we will analyze below.

IS THIS ALSO CALLED NIE?

NO, IT IS NOT. NIE and Residence card are often confused, but they are very different things.

N.I.E.: Número de Identificación de Extranjeros (Foreigner Identification Number) is supposed to be a fiscal number. You may need this number in order to buy a house, a car or open a bank account. Nowadays it is not very relevant by itself, so police do not provide them that easy anymore.

RESIDENCE CARD: This is a small piece of paper (in the past it used to be a green A4 format document) certifying you are registered as a resident in Spain (on Registro Central de Extranjeros or central register of foreign nationals).

IS IT EASY TO GET REGISTERED AS A RESIDENT IN SPAIN?

No, it is not. As mentioned above, to get registered as a resident in Spain you need to fulfill some requirements, which basically means you need to belong to any of the following situations:

- You are a worker in Spain,

- You are registered as autónomo (self-employed) in Spain,

- You are a pensioner in Spain,

- You are a student and registered in an official public or private centre in Spain and have enough incomes or savings to live in Spain and a full health insurance.

If you don’t fit any of the cases above, don’t worry. Basically, you can also become a resident if you fulfill the following requirements:

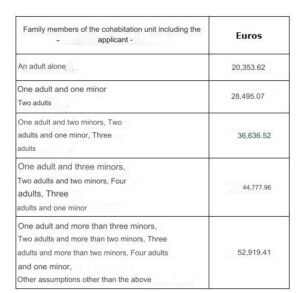

- You have savings (please see below) to cover your family and yourself living in Spain,

- You have a full health coverage. It can be through a private insurance or because you are covered by the health system in your country (providing you an S1 or 121, form).

WHAT ARE THE MAIN DIFFERENCES BETWEEN BEING AND NOT BEING A RESIDENT IN SPAIN?

The following table describes the main differences between residents and non-residents in Spain:

[table id=32 /]

CAN MY HOME COUNTRY KNOW IF I AM A RESIDENT IN SPAIN?

No, it cannot. Only if you provide them a residence certificate, your home country can know you are a resident abroad.

Therefore, it has nothing to do with taking a tax declaration or losing a pension, for instance.

CAN A POLICEMAN KNOW IF I AM RESIDENT IN SPAIN?

Yes, it can. Let’s explain a case:

A foreign resident couple driving a foreign car is stopped by a policeman. The couple know they cannot drive a car with foreign plates if they are residents, so they tell the policeman they are not residents. The policeman checks the system and discovers they are residents in Spain. The policeman “fines” them with €300.

DO I HAVE TO TAKE THE DECLARATION TAX IN SPAIN IF I BECOME A RESIDENT?

No, you don’t. You don’t have to take the declaration tax or you can take in your home country unless:

- You earn more than €22.000€/year (personal incomes of work in Spain!) and/or

- You are a self-employed in Spain and/or

- You have 2 or more payers (for example, you receive a pension from Spain and from your home country) paying you €1.500 or more per year.

IN SUMMARY

If you are staying in Spain for more than 3 months, you are supposed to be a resident. European citizens must be registered as residents according to the Spanish laws. Besides, there will be many things you will not able to do if you do not officially become a resident.

Tom Parkinson

January 14, 2019 @ 7:33 pm

Hi Javier,

Thanks for the post, it’s been one of the more useful bits of information out of the hundreds I’ve read.

I am British and live in the UK and my girlfriend is Spanish and lives in Spain. I’ve spent too long without her in my life so I have decided I am going to Spain in May to stay with her for at least 90 days. While I’m there I’d like to try and find a job and become a resident but I have no idea in what order to do everything. Do I apply for residency before I find a job, or after, but if I don’t find a job within 90 days will I have to return? It’s all so confusing.

I will have savings but only around 3000-4000 euros which from what Ive read wouldn’t be enough to apply for residency. I’d be staying at her parents so I wouldn’t be paying rent, so this money would last me at least 6-9 months.

Do you have any advice?

Thanks

Javier Rodríguez

January 16, 2019 @ 2:27 pm

Hello Tom,

The minimum amount to be provided as savings by the police offices is around 4800€, and many of them ask this bank account balance to be 6 months old (this depends on the office).

Im sorry for the bad news…

Regards

Cheryl

January 2, 2019 @ 4:12 pm

Do I need to make an appointment by phone to go to the Foreign Office in Almeria, or can I request an appointment by email, as I don’t speak Spanish and I would need to translate it in an email? Also what is the address of the Foreign Office in Almeria.

Javier Rodríguez

January 7, 2019 @ 1:18 pm

If you are an EU citizen, you should go to POLICIA NACIONAL, not to the foreigner’s office. The appointment system will depend on the office.

Martin Scothern

December 21, 2018 @ 3:08 pm

Can you confirm that the 90 residency period is consecutive , I want to travel and would like to spend the winter in Spain and Portugal . If I spend two months in Spain , travel to Portugal for a month and return to Spain for two months will this still qualify as being over 90 days and therefore require registration .

Javier Rodríguez

December 28, 2018 @ 2:47 pm

Hello Martin,

Yes, those 90 days should be consecutive.

Kind Regards

Laura

October 10, 2018 @ 8:27 pm

Brexit has put me in a very difficult position and I hope you can help me.

I had planned on coming to Spain next year, travelling to different areas to find a area and buy and property in that area to retire.

However, because of Brexit, I have now decided to come out to Spain next month (November 18) rent, and apply for my NIE and Residency. This is because it is unknown how difficult it will be after March 2019.

I am not sure I am doing the right thing but I dont want to be in a position where, after Brexit, it will be too difficult for me. I will have to come back to the UK to finalise packing etc.

In your opinion what is the right thing to do?

Javier Rodríguez

October 14, 2018 @ 5:23 pm

Hello Laura,

It is difficult to know due to the changing situation of Brexit nowadays. Nevertheless I would say that in case of a hard scenario, if you want to live abroad this is the momment to do it.

Apart from applying for residency (you do not need a previous NIE, by the way), I would apply for PADRON as well. There is a related post in our blog about PADRON or EMPADRONAMIENTO.

I hope it helps.

Pam

October 8, 2018 @ 12:53 pm

A family member has been living and working in Spain for the past 3 years. They have an NIE no.,work and pay their taxes through the company. They also have a Spanish bank account and a rental agreement on an apartment. They did not apply for residency as didn’t realise this was necessary, especially as their intention was not to permanently stay in Spain or make any claim whilst there.

Due to a bereavement of a friend in Spain the question of residency has come up and now she is worried she has broken a Spanish law by not registering as living there.

Can you advise please

Javier Rodríguez

October 9, 2018 @ 4:26 pm

Hello Pam,

You should become registered as an EU citizen in Spain if you are staying for more than 90 days consecutively, but there 2 main requirements that they do not fulfill, as far as I read. Therefore, they cannot apply for residencia but at the same time they cannot be banned from stayingin Spain as long as they want.

In summary, no they cannot be fined or whatsoever if they stay in Spain for a long time but they do not work, since they are EU members.

I hope it helps.

Fiona McAnallen

March 9, 2018 @ 6:52 pm

Hi… im living and working in Spain .. i have a green NIE cert which i thought was residency.. iv got a social seruriry number and also a health card… is residency something else i need ????

Javier Rodríguez

March 12, 2018 @ 2:14 pm

Hello Fiona,

Nope, that’s all you need as a resident in Spain. Please just note you may need a “Padron” (registrarion at the town hall, “empadronamiento”) as well. Remember also to renew your green residence card after 5 years for a permanent one.

I hope it helps.

Regards,

Javier

Martin

February 8, 2018 @ 9:38 pm

Hi, this information is really useful however I am a little confused about the tax status of a person earning less than €1600 a month but resident in Spain for more than 183 days a year.

Javier Rodríguez

February 12, 2018 @ 2:54 pm

Hello Martin,

In order to solve your confusion, I recommend you to read the new post a just published about declaring taxes in Spain:

https://www.spain-help.com/legal/declare-taxes-spain/

I hope it helps.

Sylvia Cheal

February 2, 2018 @ 9:13 am

Hello

My husband (British Passport) has lived in Canada for many years and holds a Canadian Drivers Licence. How can he get a Spanish Drivers Licence without having to go through driving schools, tests etc.

He is 73 years old and been driving for 55 years !

We are Spanish Residents and have been living in Spain for one year.

Thank you

Javier Rodríguez

February 12, 2018 @ 12:43 pm

Hello Sylvia,

Unfortunately, Spain doesn’t have any agreement (Convenio) with Canada. So he must apply for a new driving licence in Spain in that case, I am afraid.

Debbie

January 31, 2018 @ 9:20 am

Regarding driving a car with non-Spanish plates, is this any vehicle, i.e. a non-resident’s vehicle if they are visiting, or a van hired in the UK to bring your possessions over, or just one that a resident actually owns? Thank you

Javier Rodríguez

February 12, 2018 @ 12:42 pm

Hello Debbie,

If you are a resident in Spain, you cannot drive a car with non-Spanish plates, that’s all (whether it is yours or not). And even if you just show the policeman your passport suggesting you are not a resident, he will know.

John Curson

January 30, 2018 @ 4:41 pm

Javier, thank you for this information. My wife and I moved here in November 2017 and want to be as legal as we possibly can. We were issued with A4 style white paper NIE numbers back in March 2017 to enable us to purchase our house. We got ourselves on the padron in November 2017. We were advised the we had 183 days to apply for residencia but perhaps that is wrong – some things here are so confusing.

snikpoh

January 30, 2018 @ 5:57 pm

John – You should only be on the padron if Spain is your habitual residence. If it is, then within 90 days you should register as resident.

The 183 days ‘rule’ is that after being in Spain for over 183 days in any calendar year, you are automatically considered tax or fiscally resident. This means that you are obliged to complete a tax return on ALL world-wide income.

Javier Rodríguez

February 12, 2018 @ 12:40 pm

Hello John,

Well, if you are a resident, things will be easier. It is a right but many people including policemen think it is an obligation. It can be an obligation if your home country has this rule, but not Spain.

Ronaldo

July 26, 2018 @ 5:00 am

Javier, thanks for the information. I have the following exceptional situation. I am not a fiscal resident in Spain as I work overseas for about 10 months per year. I own an apartment there and because I am there regularly I thought it would be benefical to register at the registro central de extranjeros. Being a non fiscal resident, in which way is the registration in this registro central necessary? And more importantly, being included in this registro, does this mean I could be considered a fiscal resident too? Thanks Ronaldo

Javier Rodríguez

July 26, 2018 @ 4:42 pm

Hello Ronaldo,

If you own a house in Spain, it does not mean you are a resident. In fact, instead of IBI you should be paying the non-resident tax.

The “registro central de extranjeros” is, basically, residencia, if you spend in Spain more than 180 days in Spain. And it is not automatic, you need to apply for it.